Web Scraping for Market Research: In Depth Guide (2025)

In 2025, market research doesn’t begin with a Google search or an agency brief. It begins where your market actually shows up: on platforms like Amazon, Reddit, and category-specific marketplaces. People are sharing opinions, asking questions, leaving reviews, and shaping trends.

Whether you're launching a product, entering a new vertical, or iterating on an internal product line, fast, reliable insights are critical. You need a way to see the market as it behaves today, not six months ago and not in a survey answer.

This is where web scraping, when done correctly, becomes one of your most powerful tools. But the key isn’t just pulling data. It’s turning that data into decisions.

This guide will teach you how to perform web scraping to market research. We will research and analyze magnesium supplements on Amazon.

Why Web Scraping Now Replaces "Traditional" Research

Surveys are slow. Focus groups are expensive. Third-party reports are outdated the moment they’re published. Even CRM data has a blind spot—it only tells you what’s true for the customers you already have.

Web scraping flips that.

It gives you:

- Real-time visibility into what people are buying and why

- The actual language customers use to describe pain points

- Pricing intelligence across platforms

- Messaging and UX patterns from competitors

In short, scraping helps you listen to the market at scale.

Where This Fits: Market Research vs. Audience Research

Let’s clear something up. This isn’t a replacement for qualitative interviews, jobs-to-be-done (JTBD) calls, or sales enablement research. This complements them.

Market Research = Where to play (category demand, pricing bands, competitors, shelf visibility)

Audience Research = How to win (language, behaviors, unmet needs, objections)

Web scraping is your lens into both. It gives you wide-angle insights (market trends) and zoomed-in details (review sentiment, copy tone, product angles).

Use Cases: Real Research You Can Run with Web Scraping

1. Category Trend Discovery

- Scrape Amazon, Target, Walmart, and Shopify collections to identify which product categories are gaining traction

- Track seasonal product launches and review velocity

- Useful for: Planning new launches, demand forecasting, content calendars

2. Competitor Messaging Deconstruction

- Scrape landing pages, meta descriptions, PDP bullet points

- Analyze CTA structure, headline formats, feature vs. benefit split

- Useful for: Positioning audits, copywriting sprints

3. Pricing Intelligence

- Scrape current and historical prices on Amazon, Instacart, DTC sites

- Track discounts, bundles, Prime eligibility

- Useful for: Testing new pricing strategies, forecasting margin potential

4. Sentiment Mining from Reviews

- Scrape top reviews for all ASINs in a category

- Use NLP tools (VADER, TextBlob) to tag tone and themes

- Useful for: Product development, email copy, upsell targeting

5. Lead List Creation (for B2B ecommerce vendors)

- Scrape Shopify store directories or Etsy seller profiles

- Filter by SKU count, traffic estimates, or product category

- Useful for: Partnership outreach, wholesale targeting

Tools We Recommend

You don’t need a CS degree. You just need the right tools. Here’s what we’ve seen work best for ecommerce teams:

| Need | Best Tool |

|---|---|

| Custom scripting | Python |

| E-commerce APIs | Unwrangle |

| Data cleaning | Pandas, OpenRefine |

| Review analysis | VADER, TextBlob |

| Visualizations | Power BI, Tableau, Seaborn, Plotly |

Let’s Build One Together: Researching Magnesium Supplements on Amazon

Let’s say you're launching a wellness supplement, a magnesium complex designed to support stress recovery and better sleep. Before you launch your product, you want answers to critical questions:

- How do top competitors describe their products?

- What pricing clusters dominate the category?

- What do real buyers love, and what do they complain about?

You don’t want opinions. You want patterns from real shopper behavior. This is where API-powered audience and market research comes in.

Here’s how you can use Unwrangle’s Amazon APIs to gather deep, structured insights in under a day.

Step 1: Start With a Focused Research Question

A strong question sets the tone for relevant, usable insights. Think:

"What language do top magnesium supplement customers use to describe benefits, and what frustrations do they consistently report in reviews?"

With something like that, you’re ready to start.

Step 2: Get Top Products with Unwrangle’s Amazon Search API

Use Unwrangle's Amazon search API to surface top-ranking products based on Amazon’s actual search results. These are the products your audience is discovering when they search for your category.

You can sign up on Unwrangle to get your API key.

We will scrape the top five pages of Amazon results. This should be enough data for analysis.

Python code:

Step 3: Pull Detailed Product Data Using the Amazon Product Detail API

Now use the Amazon Product Detail API from Unwrangle to pull all available metadata for each product, including reviews, pricing, shipping info, seller names, categories, variants, and more.

Python code:

Now, we have detailed data of 276 magnesium supplements from Amazon of different brands.

Step 4: Structure the Data for Insight

On Google Colab, use Pandas and JSON to load and normalize the scraped data so it is ready for analysis. Begin by opening the product data you saved from the Unwrangle API in the previous step.

Step 5: Analyze the Patterns

Use sentiment analysis and keyword matching to surface themes.

Define core product themes:

Here are results:

Step 6: Visualize for Strategy

Use structured visualizations to compare brand positioning, highlight keyword frequency, and understand customer sentiment.

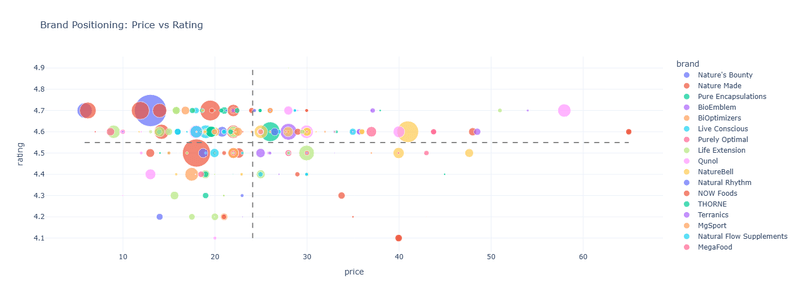

The scatter plot mapping price against average rating, with bubble size representing total review count, reveals distinct positioning strategies among leading magnesium supplement brands.

Brands such as Nature’s Bounty and BiOptimizers offer high-rated products at relatively lower price points, supported by a large volume of customer reviews.

On the other end, premium-priced brands like Pure Encapsulations maintain high ratings, indicating a successful focus on quality and niche appeal.

Brands positioned above both the average price and average rating lines appear to be commanding loyalty while justifying their higher pricing through perceived value.

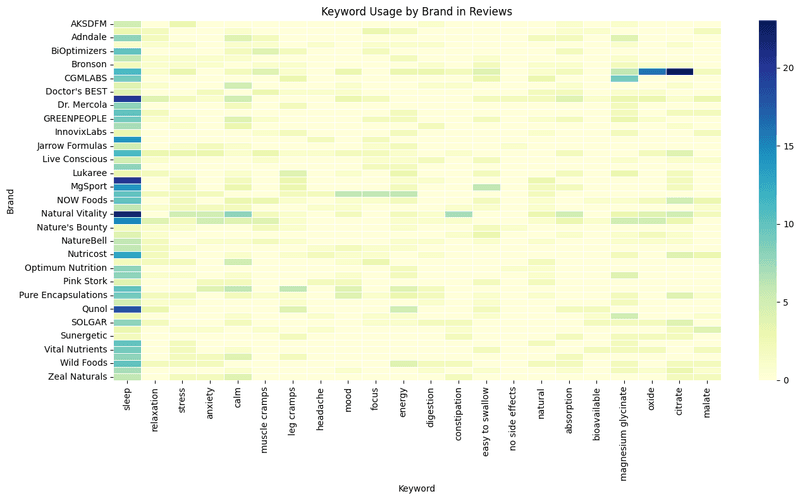

Heatmap of keyword usage by brand:

The heatmap showcases that keyword mentions across brands highlights the unique angles each brand emphasizes in customer communication.

For example, Natural Vitality and Doctor’s BEST see frequent mentions of terms like "sleep," "stress," and "calm," suggesting a strong association with relaxation and mood support benefits.

Meanwhile, MgSport and NOW Foods show higher usage of more technical or performance-oriented terms such as "absorption," "bioavailable," and "leg cramps."

This differentiation can inform content strategy by aligning messaging with how target consumers describe their needs and experiences.

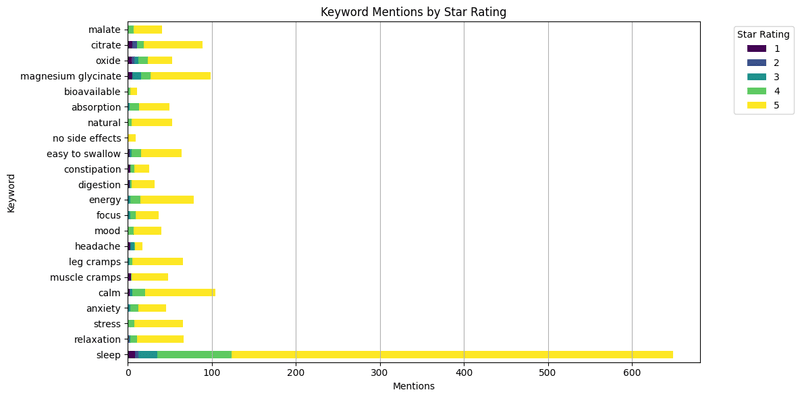

Bar chart of keyword mentions by rating:

The horizontal bar chart displays a strong correlation between positive sentiment and specific keywords.

Mentions of "sleep," "calm," and "relaxation" are heavily concentrated among five-star reviews, indicating that these outcomes are driving customer satisfaction.

Similarly, terms like "easy to swallow" and "natural" are frequently linked to higher ratings, which suggests these are valued product attributes.

Conversely, keywords such as "oxide" and "headache" appear more evenly distributed across lower ratings, potentially flagging areas of concern.

Step 7: Turn It Into Action

You now have structured insight into what drives sales and satisfaction in your category:

1. Sleep Is the Most Positively Mentioned Benefit

The word "sleep" is by far the most frequently mentioned in 5-star reviews.

Other positively associated terms include "calm," "relaxation," "stress," and "magnesium glycinate".

These results suggest that products supporting better sleep and emotional wellness are especially valued by consumers.

Takeaway: Brands that focused on promoting sleep quality and stress relief received high ratings and positive feedback.

2. High Price Does Not Always Equal High Rating

Several highly rated brands are also among the most affordable, including Nature’s Bounty and Live Conscious.

More expensive products do not consistently outperform lower-cost options in terms of customer ratings.

Some premium-priced brands even fall below the average satisfaction threshold.

Takeaway: Consumers are prioritizing value over price. A well-reviewed, affordable supplement may outperform a costly alternative if it delivers tangible benefits.

3. Brands Emphasize Different Use Cases in Their Messaging

Natural Vitality is strongly linked with keywords such as "relaxation," "calm," and "stress relief".

Doctor’s BEST and Nature’s Bounty show higher usage of terms related to "sleep" and "energy".

MgSport focuses more on physical performance, with mentions of "muscle cramps" and "leg cramps".

Takeaway: Each brand positions itself around different benefits, suggesting that aligning messaging with a specific consumer need, whether sleep, mood, or muscle health, help differentiate a product in a crowded market.

Here's how to use takeways it:

1. Write in the Customer’s Language: Use phrases and keywords directly from 4 and 5 star reviews in your product bullets, descriptions, and ads. These terms are tested and trusted by real buyers.

2. Match Price to Perceived Value: Use the price-rating scatterplot to benchmark your pricing strategy. High-rated, high-priced products suggest room for premium positioning. Low-rated, high-priced products signal a gap you can outcompete.

3. Fill Gaps Competitors Miss: If few products talk about "clean label," "bioavailability," or "no GI issues," but reviews highlight them often, that is your angle. Build your positioning and messaging around benefits others overlook.

Final Thought

You don’t need to hire a research agency to know what customers want. You need access to where they talk, search, and shop, and the right way to listen.

Web scraping lets you tap into market reality. It helps you build from the bottom up with data that reflects buyer behavior, not assumptions.

In 2025, this isn’t a competitive edge. It’s the minimum bar for making anything people want.

So, build your product research loop around scraping, and start every go-to-market motion with confidence, not guesswork.

Ready to run this process in your own market? Try Unwrangle to scrape real-time product, pricing, and review data from Amazon and other marketplaces.